September Saw a Hot Market for Buyers and Sellers!

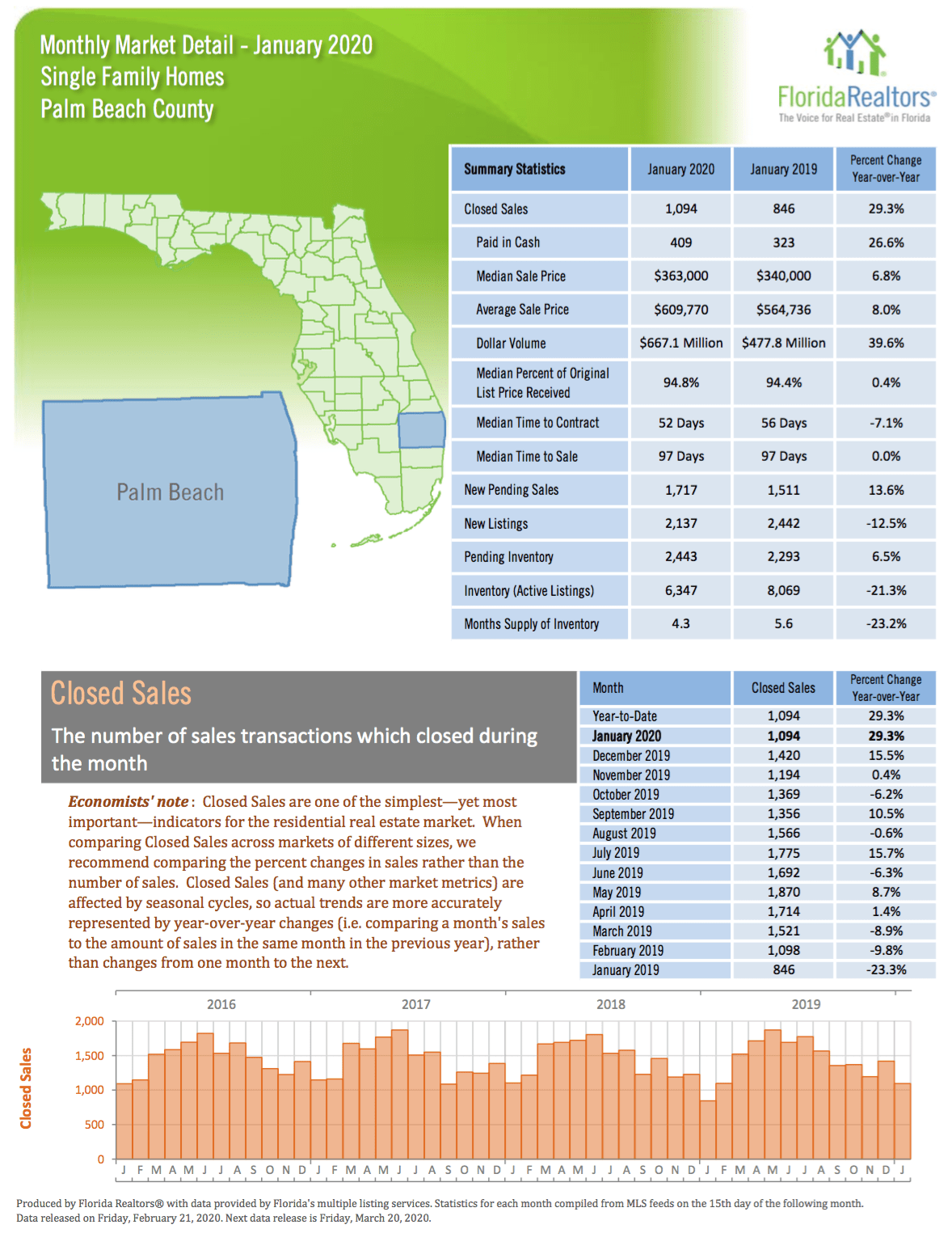

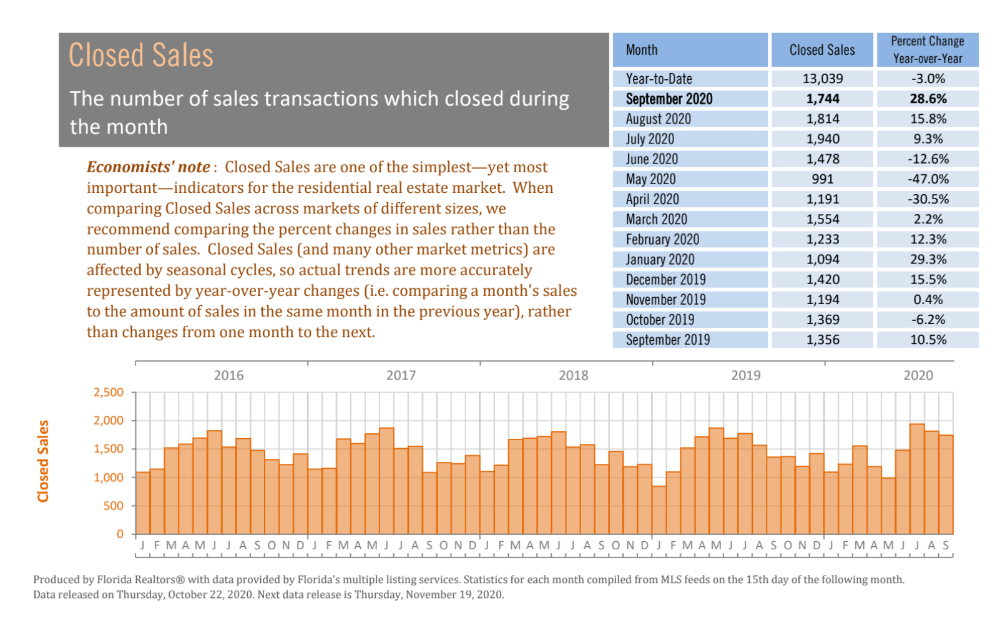

So much has changed in our world since last year— so much has changed within the Palm Beach County Real Estate Market, too. With our low inventory in PBC, the low interest rate for financing, and less and less people willing to wait on finding their dream home, the market landscape is almost antithetical to last year’s.

The time to contract and time to close is down by almost 50% and 25% respectively, showing just how decisive buyers need to be when home shopping— as options are quickly flying off the shelves! Our median sales price is up to $400,000 and average sales price is up to $656,309, as higher priced homes drive up the numbers. With such low interest rates, you might expect that most would would finance to take advantage of these historically affordable rates, but with home shopping being so competitive and cash-purchase providing a clear advantage in many cases, we’re now seeing a much higher percentage of cash closings— an almost 35% increase over the same time last year.

The market from $300,000 up to $999,999 is a sellers market.. So, sellers— be strategic on your pricing! Look at closed sales as a true benchmark, adjust accounting for low inventory, and place strategically, keeping your competition in mind. Buyers— this is not a market moment for “ifs” or casual looking; this is a moment for getting your ducks in a row and, upon finding the perfect home, getting that offer written and out there ASAP!

A market over $1,000,000 is a balanced market— so strategic pricing, curb appeal, and staging will be your greatest allies. There’s competition in this scenario, but not as much as there once was due to lowering inventories in Palm Beach County.

As realtors, we have an essential job to do for both our buyers and sellers in this fast moving market. In addition to readying a home for sale, we must work with our seller to determine which offer is the right contract for them. It’s not always simply a matter of price— the terms do matter. The strength of the buyer matters, and the relationship and teamwork with the buyer’s agent matter.

As realtors, we have an essential job to do for both our buyers and sellers in this fast moving market. In addition to readying a home for sale, we must work with our seller to determine which offer is the right contract for them. It’s not always simply a matter of price— the terms do matter. The strength of the buyer matters, and the relationship and teamwork with the buyer’s agent matter.

For our buyers, we aim to work with you to ensure you’re ready to buy when the opportunity strikes. This type of preparation tends to involve proof of funds or lender pre-approval— and not just the piece of paper that states you’re eligible for a loan, but the phase of the process that finds the lender comfortable talking to the listing agent and providing confidence in the qualifications of You, the buyer.

Representing a buyer in a multiple offer situation is always a challenge, but never an insurmountable one. It’s not simply the best or highest price that wins— it can be a matter of heart and care, too. We, as the agent team, need to demonstrate to the listing agent that we’re versed in what we’re doing and are prepared to get all of our clients to the closing table. One of the ways we accomplish this and get our buyers all the way, is by encouraging them to write a personal letter to the seller. Something to humanize the process— so that, when it comes down to decisions by the seller, it isn’t just another offer in the stack, it’s a piece of you and your story.

This month, we’ve seen a fast moving market, much competition, no shortages of offers, and homes going under contract after mere hours on the market. While this is excellent news for the economy, it can be a challenge for the individual buying or selling. So, choosing the right partner for the job is essential. We, Noreen Payne and Amy Snook of the All About Florida Homes Team of Lang Realty, are here to tackle the next step with you when you’re ready.