“I can’t express how thankful I am”

in News Room, Testimonials, UncategorizedI can’t express how thankful I am for the help and guidance you provided Bethany with the purchase of her first home. She is over the moon excited and I couldn’t be happier for her. It all happened so quickly and I am still shocked that she was so successful in this crazy sellers market!

Thank you for all you did to make this possible. I felt comfortable and confident that she was working with the best from day one. Words can’t express how grateful I was knowing she was being taken care of during this whole process and treated as one of your own. Knowing what happens in this business behind the scenes, I very pleased with the comfort and service you provided… Thank you for all you do.

— Amy, a fellow Real Estate Agent

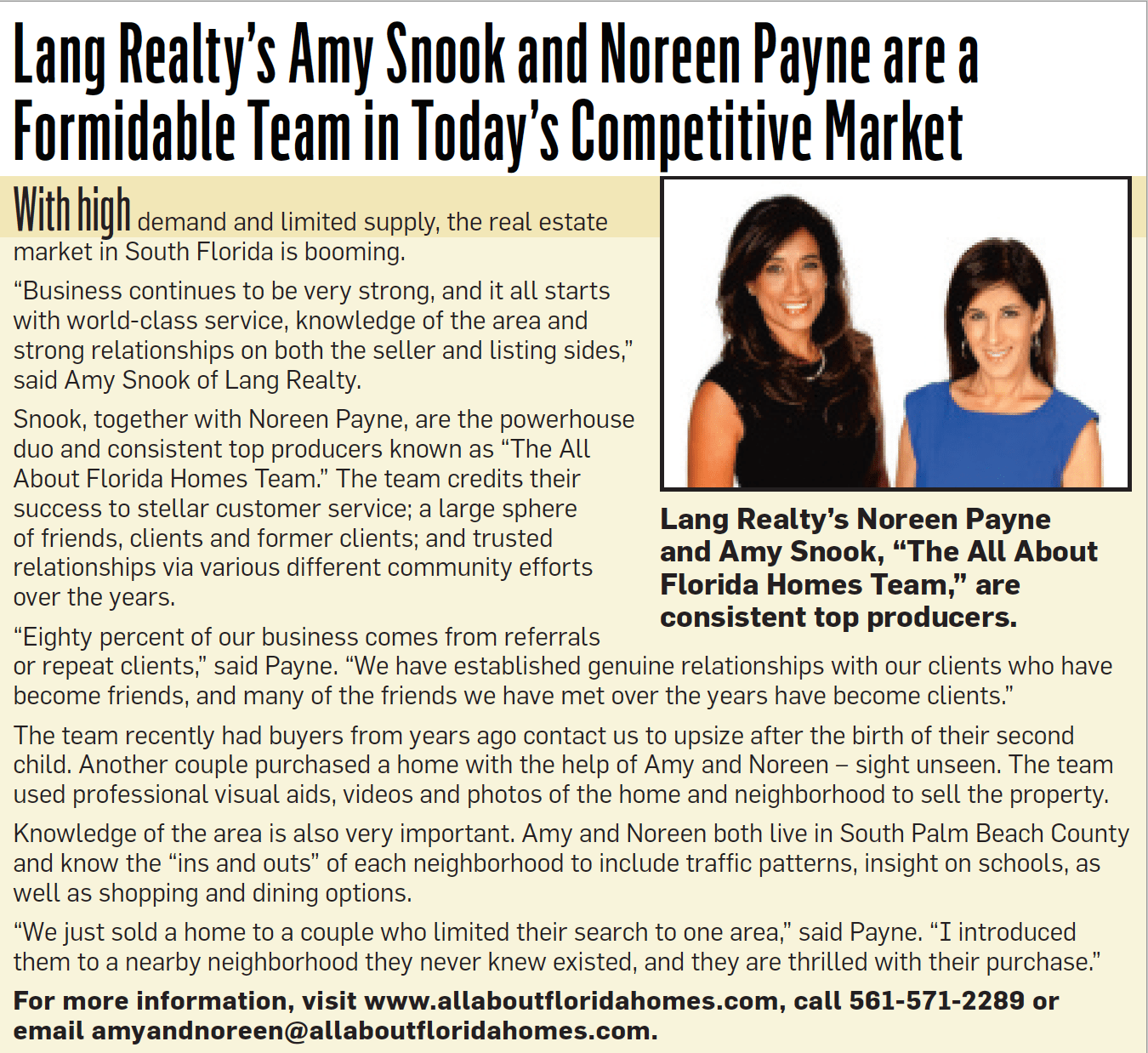

NEWSPAPER FEATURE: A Formidable Team in Today’s Competitive Market

in Buying a Home, Delray Beach, East Delray News, News Room, Uncategorized✔️ Business continues to be strong, and it all starts with world class service — we’re so excited to have been featured in the Sun Sentinel newspaper, with this lovely article that ran in the Sunday, May 16th issue!

Featured in Lang Magazine!

in News Room, South Florida LivingHot off the press this week is Issue 1.21 of Lang Magazine— and we’re ecstatic about our feature! Follow the link to learn more about and pick up tips, tricks, and listing spotlights in our area: amyandnoreendigitalmagagine

February’s Market Report

in News Room, Real Estate Market ReportThe other day, two new listings went live. In a normal market, we’d chalk this up to a delightful day. Instead, yesterday quickly became a deluge of frantic calls from buyer’s agents and consumers, all desperate for an opportunity to view and offer on these listings. Within hours of going on the market, we saw over 100 showing requests and multiple offers on both properties. This has taken shape as the new normal for us in South Florida. Inventory has been so scarce that when a new listing, especially a single family home, comes on and is priced right, it goes in the blink of an eye.

As more people manage to get their COVID-19 vaccinations, we fully expect an increase in the frequency of new listings, which spells good news for prospective home buyers in search of a new place.

That said, we’re seeing an uptick in the numbers of buyers out there, with the influx of people looking for second homes, or to relocate to South Florida away from the crowded cities and cold weather. With these market trends in mind, it’s essential that buyers are fully prepared to make an offer, and that their Realtors are strategic and well equipped to work in a multiple offer scenario. In this landscape, helping a buyer stand out is one of our most important responsibilities. Communication is key, and price isn’t the only answer to coming out on top in a multiple offer situation.

The January market report found us with some very interesting, insightful statistics.

If you’re a faithful reader of our market reports, you might remember that last January the market was busy— we had months of inventory; but comparing January 2020 to January 2021 for Palm Beach County tells quite the story

Inventory is 3 months up to $600,000— half of where it was just one year ago. The reason for this is the frenzy that occurs when a new listing goes live. The $1,000,000 price point, a highly sought after market in South Florida, has gone from 19 months of inventory (a ridiculously strong Buyers market) to a balanced market of 9 months; but these, too, are coming and going fast! This reduction of inventory we’re seeing is a result of sellers going off-market due to the pandemic, and out of state buyers venturing in, in addition to our traditional local buyers.

Even with the reduced inventory, our dollar volume is up from $667 million to $979 million. Both the average and the median sales price in Palm Beach county are up as well, with the average weighing in at nearly $850K— a reflection of higher priced homes going under contract. This hardly comes as a surprise, what with the reduction in inventory from 19 months to 9 months in just a single year.

With low interest rates, you might expect to find cash sales trending down; but they too are up from this time last year. Why, you might ask? Simple— in multiple offer scenarios, cash is king. These offers are typically desirable over their competition. I would suspect that, with this in mind, many buyers are often paying cash and then turning around after closing to do a cash-out refinance.

It’s an interesting time in the world to say the least, and a particularly interesting time for real estate. In Palm Beach County, we’re fortunate to be at the heart of such a sought after area. So sellers, if you’re considering selling? I can say with great confidence that now’s the time!

Big Hit to Second Home and Investment Mortgages — Mortgage News Daily

in News Room, Real Estate Market ReportPRESS RELEASE: Amy Snook Installed as 2021 President for the Women’s Council of Realtors

in News RoomPhoto #1: President Amy Snook, First Vice President Charmaine

Hickey, President Elect Paige Brewer, Treasurer Dinorah Guerra, and State Liaison Andrew Bell

DELRAY BEACH, Florida— Amy Snook, a partner in the All About Florida Homes Team of

Lang Realty, was installed as the Women’s Council of Realtors 2021 President for the State of

Florida at their Mid-Winter Convention in West Palm Beach, Florida.

This was the first ever hybrid convention, which included virtual and in-person events, held by

this group.

According to Ms. Snook, “I am honored to be part of the leadership of the Women’s Council of

Realtors. Success in business today is achieved through positive, productive collaboration. The

Women’s Council provides an environment in which members support each other and work

together to achieve personal growth and business success.”

Ms. Snook shared one of the highlights of the event—honoring Andre Quinton, a veteran who

served our country. As the story goes for way too many veterans, Andre was homeless for a

period of time. Ms. Snook first heard him play the piano a year ago when he wandered in off the

streets to the Delray Beach library, which has a piano sitting in the foyer. She sat there and

listened to him and learned that he is a master musician who plays by ear without sheet music.

“I always believed there are people who come into your life for a reason,” states Ms. Snook. “As

my installation speech indicated, I believe we hold pieces of each other’s puzzle of life and when

we present that piece to someone else, we hope to have enhanced their lives. I want to thank

Andre for enhancing my life. My hope is that we all can spread the word of his amazing talent

and find more opportunities to showcase his music.”

About Amy Stark Snook

Amy Stark Snook, a 1990 graduate of the University of Maryland, is a partner in the All About

Florida Homes team of Lang Realty, along with co-partner Noreen Payne of Delray Beach. She

has been practicing real estate and title insurance for 19 years and is currently the Florida State

President for Women’s Council of Realtors. Amy is also a director of the Realtors Association of

the Palm Beaches and Greater Fort Lauderdale, and a director of Florida Realtors. She resides in

Atlantis, Florida.

About the Women’s Council of Realtors

The Women’s Council of Realtors is a dynamic, accessible and diverse network, linking each

member to the tools, training and support to develop their individual leadership potential and

business goals. The Council identifies, supports and promotes the development of strong women

business leaders in the industry, organized real estate and in the broader community and provides

an influential voice and perspective for women in real estate. The Women’s Council’s local and

state networks consistently deliver high membership value and a collaborative, welcoming

environment in which members can achieve their business goals.

—Press Release Courtesy of 2021 Women’s Council of Realtors

Axios.com: Why the Corona Virus is leading Americans to move to the Suburbs

in News Room, South Florida LivingBy: Jennifer A. Kingson

Axios.com

“It’s not just emotional buying, real estate agents say: There are smart and strategic reasons that Americans of all ages, races and incomes are moving away from urban centers.

Why it matters: Bidding wars, frantic plays for a big suburban house with a pool, buying a property sight unseen — they’re all part of Americans’ calculus that our lives and lifestyles have been permanently changed by coronavirus and that we’ll need more space (indoors and out) for the long term.

Driving the news: There’s a gold rush in real estate across the U.S., driven by record-low mortgage rates and the dawning realization that for many of us, our homes are going to be the only place we work and play for the foreseeable future.

- The trend started in the spring when school was cancelled in many areas, and has gained steam as companies have allowed workers to continue working from home (in some cases, indefinitely) and as question marks have arisen over in-person school this fall.

- While spacious single-family homes in suburbs and exurbs are in hot demand, apartment rents are falling in places like Manhattan, where landlords are offering deals to entice tenants.

What buyers are looking for: Fresh air, backyards, home offices (for two adults), a homeschooling area, space for pets, home gyms — plus proximity to beaches, lakes, parks and bike paths.

- “Preferences have moved from ‘what’s a prestigious location?’ to ‘what’s practical?’ and ‘what’s the quality of life we want for our households?'” Anna DeSimone, a housing finance expert who writes guidebooks for consumers and mortgage professionals, tells Axios.

- Searches on the Compass Real Estate website for houses with pools are up threefold, searches for single-family homes are up 40%, and searches for condominiums and co-ops have decreased, Compass CEO Robert Reffkin told CNBC.

As more people do their grocery and household shopping online, proximity to retail stores is no longer a real estate priority.

- “We’re not hearing as much around brick-and-mortar, where’s the closest this-or-that,” Kris Lindahl, CEO of a real estate agency in the Minneapolis-St. Paul area, tells Axios. “Instead it’s ‘can we get delivery here?'”

Between the lines: Some people are moving because they find that — now that they spend most of their time in the same place with the same people — they are dissatisfied with their current housing.

- “When you’re spending nine-plus hours a day at home, you’re going to see things differently,” Lindahl says.

By the numbers: Existing home sales rose 20.7% in June over May, and median housing prices rose in every region of the country, according to the National Association of Realtors.

- Sales growth is particularly pronounced in more affordable regions like the South and the Midwest, Lawrence Yun, the NAR’s chief economist, tells Axios.

- One new trend he identified: “People wanting to buy out in the suburbs and away from city centers.”

Unlike in decades past, the move toward the suburbs does not represent “white flight,” but rather the work-from-home phenomenon, Yun tells Axios.

- “The people moving to the suburbs are of all races and ethnicities,” Yun said, noting that equal access to housing in all areas is “the law of the land.”

Inventory of available homes for sale — which was low even before the pandemic — has grown even scarcer, to the point that realtors are knocking on the doors of desirable homes and asking the occupants if they’d consider selling.

- “It’s been nutty for the past couple of weeks,” Andrea Paro, an agent at Compass Real Estate in Bethesda, Md., tells Axios. “I am trying to fasten the seat belt and just ride this.”

- She recently listed a single family house in Falls Church, Va., and immediately got 64 requests for showings. “I’ll probably get 10 offers,” she says.

Despite the logic in the market, some percentage of buyers are making purchases based on panic or other emotions — and those are the ones who may rue their decisions or find that their homes don’t hold their value.

- In the New York City area, that can mean that buyers are “paying $50,000 more so they can move out to Connecticut and ride their bike and go to the beach,” DeSimone says.

- All too often, she says, “When people are making an emotional or hasty decision, that real estate investment is not going to grow.”

Buyers Waiting for Prices to Come Down Will Be Disappointed

in Buying a Home, News Room, Selling A Home“Some buyers were waiting for the next recession, thinking home prices would fall again – but recessions aren’t created equal. The latest downturn exposed those myths.”- FloridaRealtors.orgBy: Russ Wiles

NEW YORK – The current economic downtown has been odd in so many ways. Why shouldn’t it expose some economic myths and misconceptions as unreliable, if not outright untrue?

When it comes to understanding the relationships involving home prices, bank deposits, interest rates and unemployment, many disconnects arise. Here are a few:

High unemployment and home prices

You might think that as the nation’s unemployment rate has spiked during this social-distancing recession, that would put pressure on home prices, forcing some owners to miss payments and discouraging buyers.

So far, that hasn’t been apparent. Home prices were up 2.5% on average this year through April, according to S&P CoreLogic Case-Shiller.

Low interest rates, which make homes more affordable, are one factor supporting prices. Also, stimulus and other government payments have enabled millions of Americans to meet their obligations. Plus, the economic slump has lasted only about four months so far, so the full impact may not have been felt yet. If the economy recovers strongly from here, negative housing fallout might not materialize in a big way.

Still, it does seem like the other shoe could drop. Fitch Ratings, the credit-rating agency, currently sees home prices nationally as 6.1% overvalued based on recent price increases, heightened unemployment and the possibility of lower incomes and rents. Values are most frothy in Nevada, Idaho, North Dakota, Texas and Arizona, Fitch said.

The degree to which housing might become more overvalued depends on the future path of unemployment and personal incomes, said Suzanne Mistretta, a Fitch senior director.

The company sees the U.S. unemployment rate easing to 7.8% next year from an average 10.3% in 2020. Though not approaching overvaluation levels of 20%-plus from 2005 to 2007, housing still could reach its highest level of overvaluation in a decade, Fitch warned.

Federal deficits and interest rates

Many people used to assume widening federal deficits would exert a crowding-out effect, pushing interest rates higher as the supply of debt mushroomed and private savings were siphoned from other investments. Few people seem to be focused on this connection anymore, given that interest rates keep dropping while Washington’s borrowing needs continue unabated.

One explanation for why the link doesn’t seem to work is the lack of inflation, as inflation and long-term interest rates tend to move together.

Another is the preference among investors for owning government bonds, which carry high credit ratings, during periods of heightened uncertainty. When things get tough, investors get nervous. They snap up government bonds with preservation of capital, not yield, as the primary goal.

As the Tax Foundation noted in a 2016 report, some economists had been suggesting that budget deficits reduce economic growth by boosting interest rates and diverting private saving toward the purchase of government debt. But in practice, “It has been hard to find an empirical link between deficits and increased interest rates or reduced investment,” the group concluded.

Rates are even lower, and deficits higher, today.

Low yields and deposit accounts

You would think that with bank deposit accounts, money-market mutual funds and other risk-averse instruments yielding next to nothing, investors would be ready to move their money elsewhere. But so far, millions of people are willing to accept virtually no yield so long as their assets remain safe.

Bank deposits spiked by $1.2 trillion in the first quarter, the most recent figure tracked by the Federal Deposit Insurance Corp. That was nearly four times the size of any other quarterly deposit gain over the past decade. Americans also have been flocking to money-market funds and other risk-averse instruments. Money-fund assets are up more than $1 trillion so far this year, reports Money Fund Intelligence newsletter.

It’s not like risky stock-market investments have been faring all that poorly. The broad market was up roughly 43% from its recent low in late March through July 9. But for a lot of people, safety reigns supreme – and they’re willing to pay a price for it, in low returns.

College graduates and layoffs

Before the recession, the vast majority of people with bachelor’s degrees who wanted jobs could get them. As recently as March, the national unemployment rate for college graduates was 2.5%. That was well below comparable figures for less-educated Americans, such as the 4.4% rate for people with only a high school diploma.

College graduates also typically earn more – $1,248 a week on average for holders of bachelor’s degrees only, compared with $746 for those with a high school diploma only, according to a May update by the Bureau of Labor Statistics.

However, that picture has changed a bit amid this coronavirus-induced economic slump. The unemployment rate for college grads more than tripled overnight to 8.4% in April and 7.4% in May before easing to 6.9% in June, according to the Department of Labor.

That’s still well below comparable rates for less-educated groups, such as the 12.1% June unemployment rate for high-school graduates. (The department also tracks workers based on whether they have some high school attainment and some college.)

Still, it lays to rest, at least temporarily, the notion that college graduates are immune from layoffs or other career bumps, especially amid an economic backdrop as strange as this one has been.

Saving money during recessions

You might think now would be a tough time to save money. During recessions and other periods of high unemployment, more people are financially stressed, the reasoning goes. It would be the time for many individuals to lean on their savings to help make ends meet.

That might be the case for a lot of people, but it certainly doesn’t tell the whole story. The nation’s savings rate often has climbed during recessions, and while real-time numbers aren’t available yet, that could be the case again.

Part of this might reflect a reluctance or lack of opportunity to spend money. Think how much you have saved in recent months by eating at home rather than at restaurants, not taking vacations and so on. Perhaps many people also are making a genuine effort to get their budgets under control by putting off various types of spending.

It’s not just individuals, either. A March survey of corporate finance officers conducted by the Association for Financial Professionals noted the largest increase in three years of businesses holding short-term investments at banks.

April 2020 Market Report!

in News Room, Real Estate Market ReportIn our last market report, we shared that the effects of Covid 19 would be evident in the April results and as forecasted the drop was drastic. Closed statistics in Palm Beach County are down 30% year over year, new pending sales dropped 54.6% and new listings are down almost 40%.

However, Believe it or not, there IS good news.

As fast as we dropped, we are already in midst of a recovery – yes, that quickly. It is being referred to as a V-shaped Economic rebound – a quick drop and a quick rebound.

Over the past six weeks the market has been showing tremendous gains – Florida Realtors even reports that the activity and results are now back to early March levels which was a “hot” market. Listings (if priced right) are coming back on and selling as quickly as they come on due to low inventory. If you are even considering selling your home, now IS the time. Stage, Price it Right, Market it properly and get ready for activity – of course, as we have shared over the past few months – ensure that your photos allow clients to truly understand the home’s layout or include a 360 walk through.

So the market has quickly rebounded but does this mean things are all back to normal?

Frankly, it is simply too soon to know. The loss of jobs, the impact of borrowers ability to obtain loans as a result, tightening credit requirements, and the impact of forbearance agreements on future loans all may and most likely will impact the market – The recovery of the economy and the job market is critical to our country and to the real estate market.

A lot can happen over the next 30 days and as workers go back to work and communities open up we are optimistic and excited to see the May results in a few weeks!

– Amy & Noreen

Contact Information

AMY STARK SNOOK

REALTOR®

NOREEN PAYNE

REALTOR®

PAIGE MERCADO

REALTOR®

Phone | 561-571-2289

Amy and Noreen Team

Lang Realty